Updated February 2022

“How do I know which medical plan to choose?”

We’ve never done a survey on it, but we’d guess this is the number one question asked during open enrollment and new employee orientation. While employees like having a choice of medical plans, they often feel unsure (and overwhelmed) about which plan makes the most sense for them and their family.

This is understandable. After all, employees have a financial stake in the benefits they choose. Even with most employers paying the largest portion of premiums, employees still have to pay their share of the plan premiums each paycheck. They incur some out-of-pocket expenses, too. And—to add to the pressure of the decision—once employees choose a plan, it is in effect for a full year (minus a qualifying life event), so they want to be sure they are picking a plan that complements their specific situation.

Providing Help with Big Benefit Decisions

While choosing the right benefits is one of the biggest decisions your employees can make on an annual basis, a report from PlanSource reveals that most people spend just 18 minutes on average enrolling in their benefits. By contrast, the average consumer spends four hours deciding to purchase a mobile phone.

The likely difference between those two decisions is that employees often don’t know HOW to assess their choices. Exactly how do you evaluate medical plans? What do you compare? Where do you begin?

When it comes to medical coverage, one of the best ways for employees to evaluate which plan is right for them is to look at estimated healthcare costs for the year. At Westcomm, we’ve developed a handful of decision support tools that help employees do just that. These tools have been positively received by employees and, as a result, have become a permanent part of many of our client’s annual open enrollment communications strategies.

Virtual Benefits Assistant

Our Virtual Benefits Assistant uses easy-to-understand terms, visual graphics, video and animation. Users are able to watch all sections or just visit the ones of interest to them.

The Virtual Benefits Assistant also includes a medical plan cost calculator that helps you evaluate which plan might be best for you and your family. You input a little information on how you anticipate using a medical plan, and it compares plans and shows you the expected costs. Employees have a greater understanding of what they are purchasing and why—and that goes a long way.

Plus, depending on where you host it, it can be accessible from work or home. This is particularly nice for a workforce that doesn’t spend much time in front of a computer (i.e. manufacturing, healthcare, hospitality). A large hospital client introduced the Virtual Benefits Assistant last year and had more than a third of their total population access it during open enrollment. The visits to the Virtual Benefits Assistant decreased the number of calls into their HR call center, so they’ve now incorporated the tool into their new employee orientation as well.

Medical Plan Cost Calculator

Our web-based calculator allows employees to enter estimated expenses—annual premiums, visits to the doctor, prescriptions, etc.—and then get a comparison of how the estimated expenses stack up with each plan. This enables employees to think more comprehensively about their medical coverage. If you don’t want a tool as comprehensive as the Virtual Benefits Assistant, this is an useful alternative that still allows employees to evaluate medical plans by comparing estimated costs.

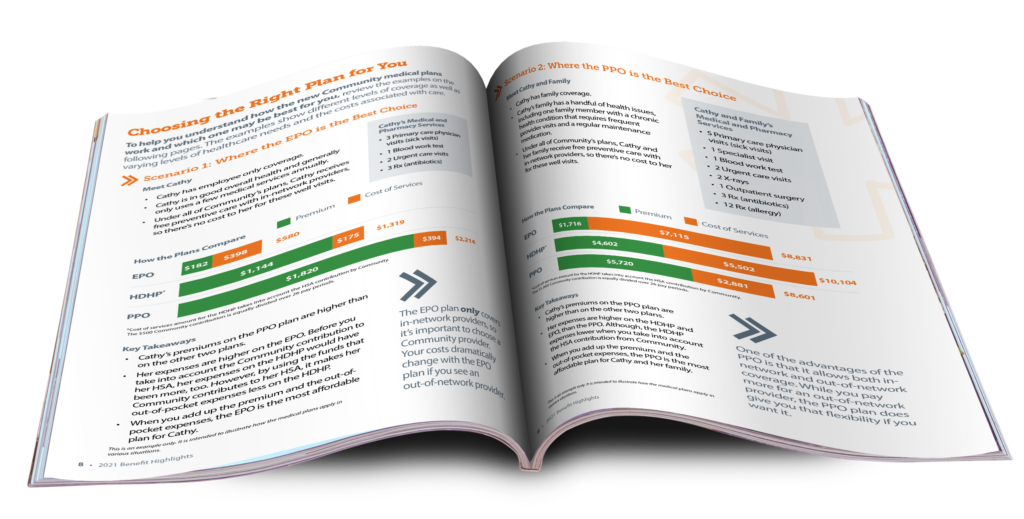

Medical Plan Scenarios

Sometimes it’s helpful for employees to see how a plan works in a particular situation. To do that, we evaluate your employee usage data and develop employee scenarios that appeal to the largest segments of your employee population. Generally, these one-page scenarios compare different coverage levels (single vs. family) and healthcare usage (infrequent healthcare needs to regular chronic conditions) to illustrate estimated costs by plan.

Choosing a Medical Plan Video

Similar in structure to the one-page scenarios, this video brings all scenarios together into one communication piece. This format is appealing to those who would prefer to watch and listen to the scenarios and see the “math” of the cost comparisons versus reading them.

Benefit choices are a great thing. It shows you understand that your employees have varying needs. If your employees need help navigating the “Which plan do I chose?” dilemma, we can help. Strategizing specific tools for your employee population is one of our sweet spots.

Want to chat? Reach out at helloindy@westcomm.com or follow us @westcomm on LinkedIn for more insights.